The new superannuation rules commence on 1 July. We have dedicated significant time and effort in analysing how the changes impact each of our wonderful clients.

Pre 30 June tasks

In the lead up to 30 June 2017, we will be contacting clients impacted by the new super changes. Our focus pre 30 June is:

- For those with super balances $1.6m, ensuring we have appropriate paperwork to reflect our intention to commute or partially commute pensions in excess of $1.6m back to accumulation or where appropriate, withdraw some or all of this amount from super.

- Contacting clients in receipt of death benefit pensions to potentially commute back to accumulation to start a new account based pension (which can be then commuted post 30 June unlike death benefit pensions)

Post 30 June tasks

After the end of the financial year, our focus will shift to other important tasks related to the new super rules. These include:

- Reviewing the level of salary sacrifice in light of the new opportunity from 1 July to make tax deductible contributions individually to super

- For those with multiple pension accounts, determining the optimal pension accounts to commute or partially commute

- Working with your preferred accountant to ensure appropriate capital gains tax relief is sought

- Reviewing your super estate planning (reversionary pensions, binding and non-binding nominations) in light of the new super changes

- Review the holding of any life insurance in super in light of the new super changes

- Reviewing SMSF trust deeds. As a general rule if your trust deed is less than 10 years old (ie written after the 2007 Simpler Super rules were introduced) then it is probably OK and you may not need to buy a new one. If it is older than this then it is likely in your best interests to upgrade

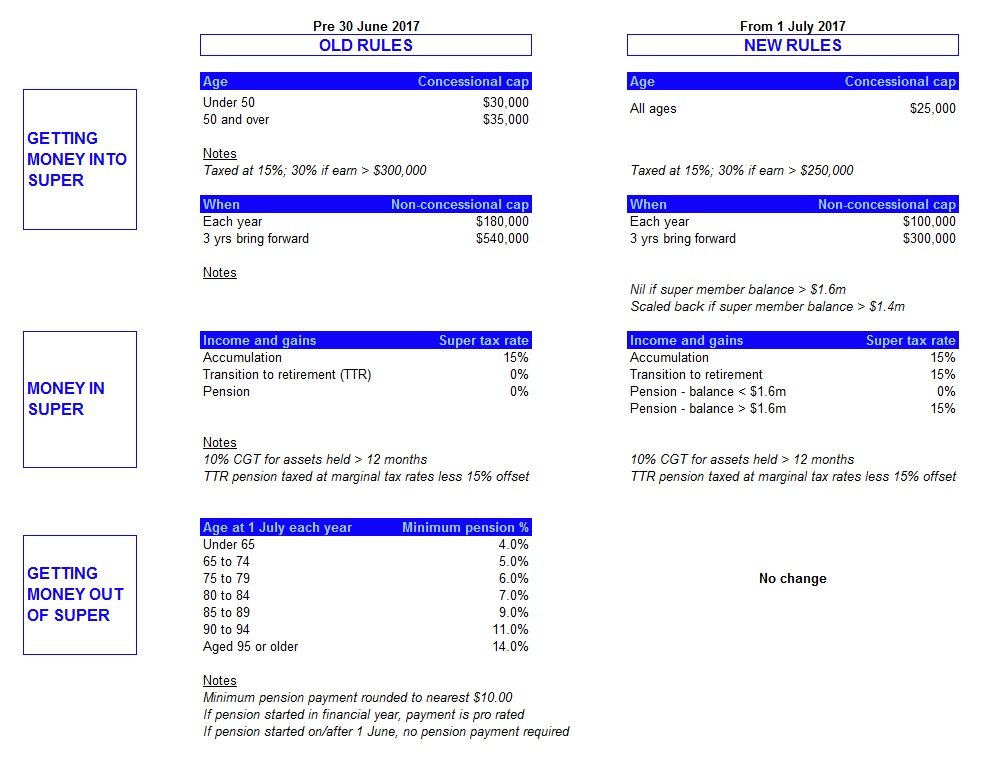

Getting money into super

For all clients who can still contribute to super, the window of opportunity for contributing money into their super is narrowing under the new rules.

Concessional (ie after tax) contributions are reducing to $25,000 for everyone from 1 July 2017 regardless of age. So if you have a salary sacrificing arrangement with your employer, make sure you review it before the new financial year.

Non-concessional (ie before tax or personal) contributions are reducing to $100,000 per year down from $180,000 per year from 1 July 2017. If you trigger the 3 year bring forward condition, it reduces from the old $540,000 (3 x $180,000) over 3 years to $300,000 (3 x $100,000) over 3 years.

If you have a super member balance greater than $1.6m, you will no longer be able to make ANY non-concessional contributions from 1 July 2017.

If you have a super member balance greater than $1.4m, your ability to make non-concessional contributions from 1 July 2017 will be scaled back.

Money in super

If you have a super accumulation account, there is no change to how it is taxed or when you can access your funds.

If you have a transition to retirement pension, the attractiveness of this strategy is reduced from 1 July 2017.

If you have ANY miscellaneous super accounts that you have not already told us about, then please inform us immediately. This information can be crucial for us to give you advice that is in your best interests. Examples of typical client professions that can accumulate miscellaneous super accounts include teachers, doctors and those who have worked for state or federal government organisations. It also includes those who have changed employers a number of times during their career.

If you receive or will be entitled to receive a defined benefit pension and you have not informed us, then again please inform us immediately. This information can be crucial for us to give you advice that is in your best interests.

Minimum pension payments

There is no change to the minimum pension rules and for those clients who have a pension account we will be ensuring they all meet their minimum pension requirement well before 30 June 2017.

Summary of key super changes

Super Changes 2017 Quantum Financial