The right advisor for the right clients

I am very open and upfront about the fact that I won’t accept everyone that approaches us as an ongoing client and we have a very honest conversation when it comes to making that decision.

That conversation involves answering three pivotal questions and encouraging the prospective client to make the same considerations

- Can I provide the services the client needs and wants?

- Can I add more value than the cost of the advice?

- And, will the client and I enjoy working together?

I encourage potential clients to ask themselves to the very same questions. If I can answer all three questions positively, then I will offer that client a service agreement. If not, I will politely say no and then openly and honestly advise them on their best course of action from there.

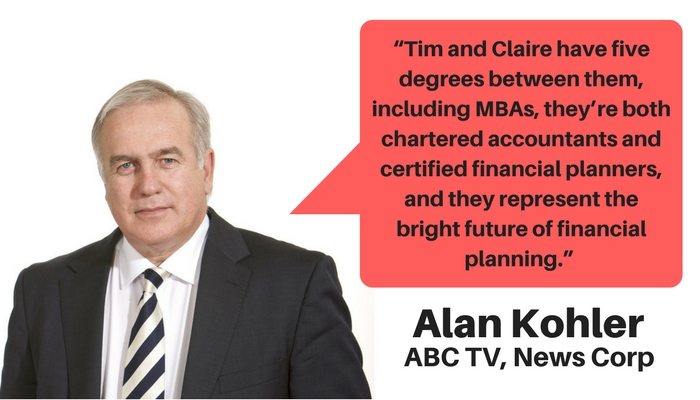

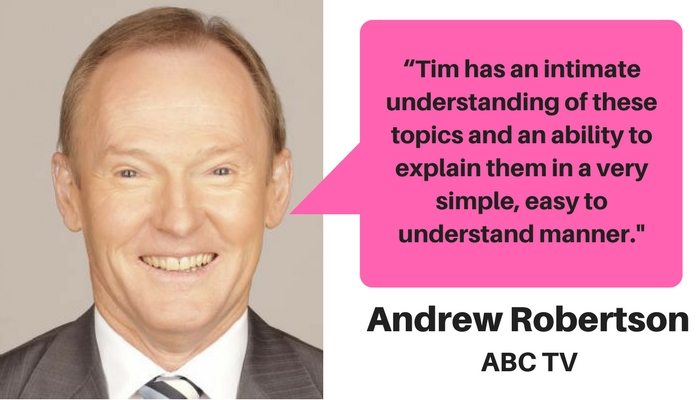

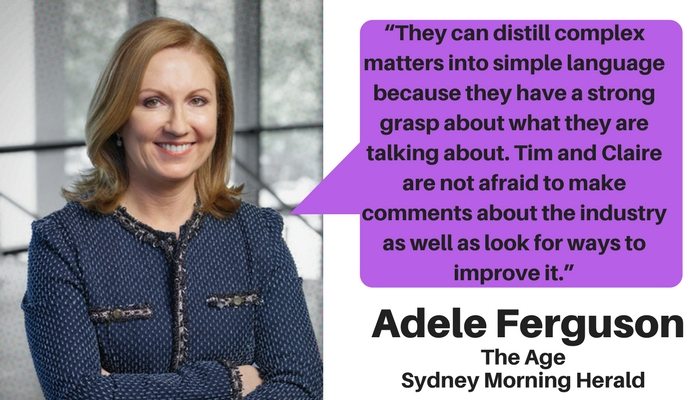

At Quantum Financial we have spent a lot of time building a business with the right client fit to ensure their our clients are not only successful but also become our greatest advocates.